The latest information on the United States tariff waves to Canada, Mexico, China, retaliatory measures, and trade modifications is as of March 6, 2025. Logistics suppliers, exporters, and importers have to be empowered with up-to-the-minute information and respond quickly to rapid changes in the global supply chain.

Counter-tariffs for $155 billion

Canada’s response

Below you will find summary excerpts from the official U.S. Customs and Border Protection (CBP) announcements on the current tariff changes for Canada, which were implemented on March 4, 2025:

- Canadian energy products. Exports of energy products from Canada (oil, gas, uranium, coal, biofuels and critical minerals) will be subject to a 10% tariff;

- General Tariff is 25% for All Other Canadian Imports. All other goods from Canada will be subject to a general tariff of 25%, except for those with special exemptions or for personal use;

- De Minimis exemption (up to $800). Goods from Canada and Mexico under $800 are currently exempt from customs duties. The exception will be canceled after the introduction of the appropriate control system;

- Cancellation of Duty Drawback. Businesses will no longer be able to receive a refund of tariffs paid;

- Changes to Foreign Trade Zones (FTZ). Goods from Mexico and China in the US FTZs are now classified as “privileged foreign status” goods and are subject to mandatory tariff taxation even after further processing;

- CBP is already applying the new tariffs. Although the official announcement is scheduled for March 6, the U.S. Customs Service (CBP) has already begun to apply the tariffs on March 4, 2025.

Canada, as the first trading partner of the United States, responded by imposing 25% tariffs, which also include 10% for Canadian energy, to maintain the competitiveness of trade of basic materials such as steel and aluminum, as well as the automotive industry and the spare parts trade.

The impact of customs changes:

- Automotive industry: Manufacturers of cars and components are forced to urgently review their usual supply channels, which creates significant disruptions in supply chains and risks of shortages of spare parts in the market;

- Agriculture: The costs of exporting beef, dairy products, and other processed agricultural products are rising significantly.

Canada’s intended countermeasures:

- Introduction of counter-tariffs worth CAD 155 billion against the United States, in particular on cars and trucks, steel, aluminum, orange juice, peanut butter, wine, and coffee;

- Consideration is being given to restricting Canadian exports of critical materials (lithium, cobalt, and rare earth metals) needed by the U.S. electric vehicle and technology industries.

Logistics implications:

- Delays and complications in customs clearance at the US-Canada border;

- Increased costs of cargo transportation due to the search for alternative logistics routes;

- Overloading of rail and road transport due to business adaptation to new supply conditions.

Doubling of tariffs to 20% for China

China is the largest trading partner of the United States in the Asian region. Due to customs modifications and tariff impositions, electronics, machinery, and automotive components, whose competitiveness is directly dependent on America, were identified as the most at risk. Check out the estimated loss projections for China’s exports by industry below:

- Telecommunications equipment: -$1.63 billion

- Computers and components: -$1.11 billion

- Motor vehicles and parts: -$439 million

- Furniture and household goods: over -$600 million

- Rechargeable batteries: -$107 million

Logistics implications:

- Increased congestion in Chinese ports as exporters try to speed up shipments ahead of a possible new tariff increase;

- Increased demand for air transportation;

- Search for alternatives — Vietnam, India, and Mexico are strong contenders for Chinese production and new markets.

Timeline of China’s retaliatory measures

February 10-17, 2025:

- The first stage of countermeasures was marked by the following trade modifications:

- 10-15% duties on agricultural products from the United States;

- an additional 15% tariff on exports of liquefied natural gas (LNG) and coal from the United States;

- restrictions on the export of rare earth metals required for the US technology industry.

Starting from March 4, 2025:

- Suspension of soybean import licenses for three large US companies – CHS Inc, Louis Dreyfus Company and EGT (temporarily);

- Suspended imports of US timber, citing phytosanitary risks as the main reason (fully).

Since March 10, 2025, the additional round will include tariffs on imports of products from the United States, namely chicken, wheat, corn, cotton (15%) and soybeans, sorghum, pork, beef, seafood, fruits, vegetables, and dairy products (10%).

Elaboration of countervailing tariffs from Mexico

Live updates on results (March 6):

- One-month duty exemption for the automotive industry for Mexico and Canada.

- Counter-tariffs declared by the President of Mexico, Claudia Sheinbaum, on March 5, 2025.

- Planned implementation: March 9-16, 2025.

- Key insights:

– Seeking new alternative trading partners, including Canada, Asia, and Europe for crude oil exports;

– Non-tariff measures: regulatory control over US companies operating in the country;

– Details on targeted products and counter-tariff measures are expected.

Earlier, tariffs of 25% were announced for Mexico, which primarily put the automotive, electronics, parts, and agricultural industries at risk.

The following are among the consequences of response from Mexico:

- increased demand for air transportation of perishable products;

- Changes in routes that will lead to increased costs for rail and freight transportation between countries;

- a decline in U.S. imports due to rising costs;

- dominance of the search for vendors from countries with alternatives to the United States;

- increase in prices for products for American residents;

- retaliatory tariffs on American agricultural products, steel, etc.

Expected tariff modifications

- Tariffs on steel and aluminum rise to 25% worldwide on March 12, 2025.

- Reciprocal tariffs on EU imports go into effect on April 2, 2025, with a focus on automobiles and industrial items.

- Consider for shipping & trading businesses

- Monitor tariff classifications regularly and prepare for duty drawback elimination;

- Anticipate higher costs and supply chain interruptions in auto, energy, and food;

- Diversify suppliers, seeking options in Vietnam, India, and Brazil;

- Anticipate border delays, port congestion, and higher freight rates; negotiate freight contracts beforehand;

- Use bonded warehousing to delay tariffs, expedite customs clearance, and employ air freight for valuable shipments.

- Don’t miss the chance to book your freight

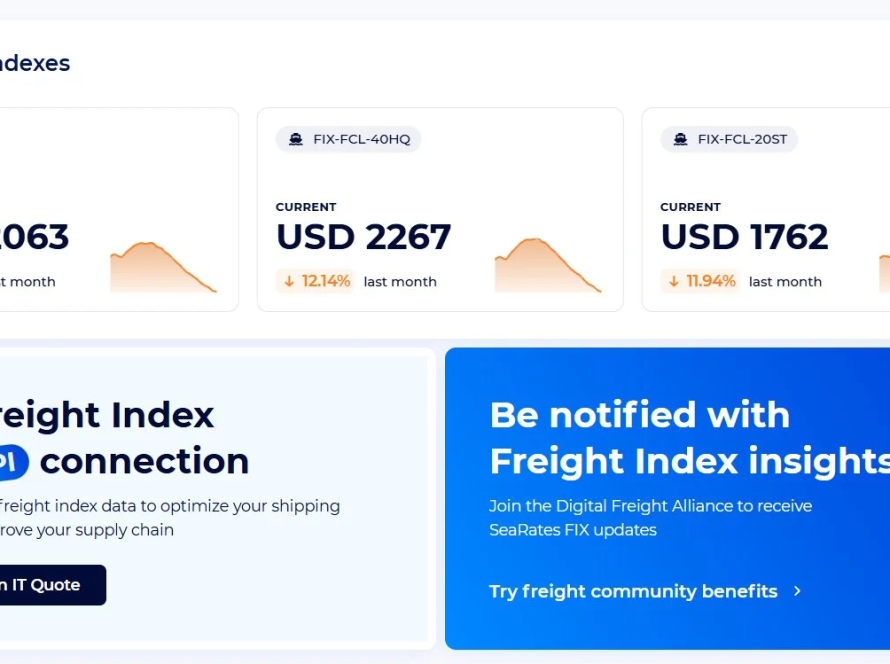

- Try SeaRates Logistics Explorer tool now to streamline your logistics operations and successfully cope with these challenges. Using the tool, you can:

- Get the most up-to-date tariffs and quickest routes with a real-time freight rate calculator for shipping by sea, air, road, and rail;

- Find the most affordable shipping options by comparing rates from various carriers;

- Book your transportation instantly online to fix affordable prices and get a cargo space guaranteed;

- Make logistics planning easy and transparent, with all expenses visible.